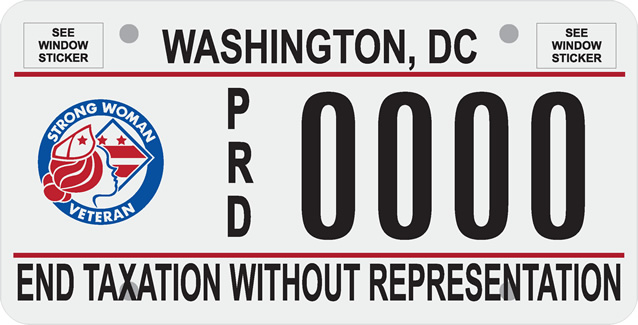

dc auto sales tax

The District offers a tax exemption for EVs and high efficiency vehicles. Motor Vehicle Excise Tax.

Skylink 0 75 Hp Atoms Smart Chain Drive Garage Door Opener Led Light Lowes Com Garage Doors Garage Door Opener Best Garage Doors

DC DMV Service Update.

. A tax rate of 7 is charged if the vehicle weighs between 3500 and 4999 pounds and 8 is charged for vehicles that weigh at least 5000 pounds. A sales tax of 6 percent is charged on the MSRP of any new vehicle purchased in Washington DC. Based on manufacturers shipping weight.

As a result of recent regulatory changes DC DMV has revised the calculations for motor vehicle excise taxes. Groceries prescription drugs and non-prescription drugs are exempt from the District of Columbia sales tax. The motor vehicle saleslease tax also applies when use tax is due on demonstration executive and service vehicles.

The District of Columbia however does not charge state sales tax for any. Motor Vehicle Fuel Taxes. RCW 82144504 provides an exemption from the public safety component of the retail sales tax approved by voters in a city or county.

The Washington DC sales tax rate is 6 effective October 1 2013. The updated excise tax rates will take into account the fuel efficiency of motor vehicles as mandated by Title V of the CleanEnergy DC Omnibus amendment Act of 2018. For more information visit the FAQ page.

Thus vehicle sales taxes in Washington can range from 73 to 103 based on where the transaction is made. Make sure you know whether the vehicles sales price includes the Districts excise tax. Ask the Chief Financial Officer.

Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington. Many vehicles are exempt from DC excise tax. Information on the excise tax for DC titles can be found at DC Official Code 50-220103.

In addition there are also four tiers of excise taxes levied against a new car or truck. Walk-in service has returned to DC DMV for all Service Centers and Adjudication Services. Review our excise tax exemption list Rates are applied to the fair market value as defined by the current National Automobile Dealers Association NADA Business Guide for the Eastern Region of the.

Youll find rates for sales and use tax motor vehicle taxes and lodging tax. The DC DMV Vehicle Registration and Title Fee Estimator is provided to assist District residents in calculating the excise tax registration inspection tag title lien and residential parking fees. 7 of fair market value - 3500 to 4999 lbs.

Three are based on the same weight classes as the registration fees and come out to 6 7 and 8 percent of the fair market value of the vehicle respectively. While tax rates vary by location the auto sales tax rate typically ranges anywhere from two to six percent. Exact tax amount may vary for different items.

Additional information about the various components which make up the registration and title fees can be found at the links below. The cigarette surtax will be 36 for a package of 20 cigarettes which raises the total tax to 286 per pack of 20 cigarettes. Remember to convert the sales tax percentage to decimal format.

In lieu of sales tax collected by vendors there now will be a cigarette surtax levied on cigarettes sold. The statewide motor vehicle surtax or 003 has been collected since 2003 applies to all retail sales leases and transfers of motor vehicles and is used to finance transportation improvements. Do not use the sales tax forms to report and pay the gross receipts tax.

2022 District of Columbia state sales tax. 8 of fair market value - more than 5000 lbs. Note that while the excise tax on vehicle sales is processed through DC DMV the use tax for leases is processed through the DC Office of Tax and Revenue.

The tax is collected by the vendor at the. Thorough research of the vehicle you are considering purchasing including vehicle registration and title histories can be obtained from several companies such as Carfax. Spirituous or malt liquors beers and wine sold for off-premises consumption by certain the Alcoholic Beverage Control Board licensed vendors are subject to the 10 sales and use tax rate.

Sales and Use Taxes. 6 of fair market value - 3499 lbs or less. For private sales you should also obtain a bill of sale.

Masks are still required at DC Gov facilities with direct interaction between employees and the public. Issuance of every original and subsequent certificate of title on motor vehicles and trailers. Title 47 Chapters 20 and 22.

In 2019 the median excise tax per vehicle purchase was 680. This is a single district-wide general sales tax rate that applies to tangible personal property and selected services. For example if your state sales tax rate is 4 you would multiply your net purchase price by 004.

How to buy and sell a vehicle in the District. Acting Chief Financial Officer-A A. Please continue to wear your mask at all DC DMV facilities.

Title 47 Chapters 20. The excise tax is expected to be revised in 2021. Use tax is imposed at the same rate as the sales tax on purchases delivered outside the District and then brought into the District to be used stored or consumed.

These changes become effective on February 1 2021. Current Tax Rates The rate structure for sales and use tax that is presently in effect. 1101 4th Street SW Suite 270 West Washington DC 20024 Phone.

For packages that contain more than 20 there will be an additional 18 for each cigarette above 20. The District of Columbia collects a 6 state sales tax rate on the purchase of all vehicles that weigh under 3499 pounds. Motor vehicles with fuel economy in excess of 40 mpg including EVs are eligible for an exemption for paying the vehicle excise tax.

Look up a tax rate. In recognition of Memorial Day all DC DMV locations will be. Multiply the net price of your vehicle by the sales tax percentage.

Effective October 1 2011 the District of Columbia sales and use tax rate applicable to gross receipts from the sale of or charges for the service of parking or storing motor vehicles or trailers has been increased from 12 percent to 18 percent. For assistance with MyTaxDCgov or account-related questions please contact our e-Services Unit at 202 759-1946 or email e-servicesotrdcgov 815 am. Title 50 Chapter 22.

Friday September 2 2011. Search by address zip plus four or use the map to find the rate for a specific location. The District of Columbia state sales tax rate is 575 and the average DC sales tax after local surtaxes is 575.

Special reporting instructions for sales or leases of motor vehicles.

86 Reference Of Car Insurance Nj Vs Ny Cars For Sale Car Car Insurance

Car Donations For Sale Toy Car Car Donate

Car For Sale Cars For Sale Used Cars Car Buying

Pin By Chevy Chase Acura On Https Www Chevychaseacura Com Acura Acura Cars Used Cars

Ebay Mgb Gt Red Signal Red Wire Wheels Tax Exempt 1970 Classicmg Mg Mgoc Classic Car Sales Wire Wheel Cars For Sale

Car Mini Inflatable Pump Electric Tyre Pressure Monitor Compressor Portable Dc 12v Deal Sale In 2021 Compressor Inflatable Tire

Hyundai Stellar Ad Hyundai Stellar Ad Advertisement Classic Vintage Retro 역사

Wonder Woman Symbol Patch Superhero Costume Emblem Dc Comics Etsy In 2022 Wonder Woman Logo Super Hero Costumes Superhero Patch

2015 Hyundai Genesis Pinterest

5pcs In Line Car Blade Fuse Holder Waterproof 30a 12v Dc Car Bike Free Shipping Car Fuses Bikes For Sale Bike Prices

Us 238 99 17 Off 12v Dc 5t 3 In 1 Auto Car Electric Hydraulic Floor Jack Lift And Impact Wrench Car Repair Tools From Automobiles Motorcycles On Banggood C Lathe Tools Cnc Lathe Lathe

1965 Ap6 Chrysler Valiant 225 Slant Six Sedan Safari Wagon Aussie Original Magazine Advertisement Car Advertising Australian Cars Chrysler Valiant

12v Dc Car Electric Oscillating Fan Portable Cooler Clip For Vehicle Van Trunk Portable Cooler Oscillating Fans Electric Cars

Auction Type Vs Buy Now Model Car Auctions Car Prices Bmw Car Price

Ebay 1963 Auto Union Dkw Station Wagon Classiccars Cars Station Wagon Wagon Classic Cars