how to lower property taxes in pa

Free Case Review Begin Online. Rocky and Adrianna own a home in Pennsylvania on which the assessor has placed a.

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Applicants need to meet the required age criteria by the end of the year to qualify for tax relief in that year.

. To qualify for this tax relief you need to meet certain requirements. Different jurisdictions have different policies and. See If You Qualify For IRS Fresh Start Program.

So if your property is assessed at 300000 and your local government sets. Property Tax Reduction Allocations 2022-2023 Fiscal Year. Property tax is determined by multiplying the property tax rate in your area by your homes current value.

For example in New Mexico the property tax rate is about 79 percent. Pennsylvania will continue its broad-based property tax relief in 2022-23 based on Special Session Act 1 of 2006. According to a report.

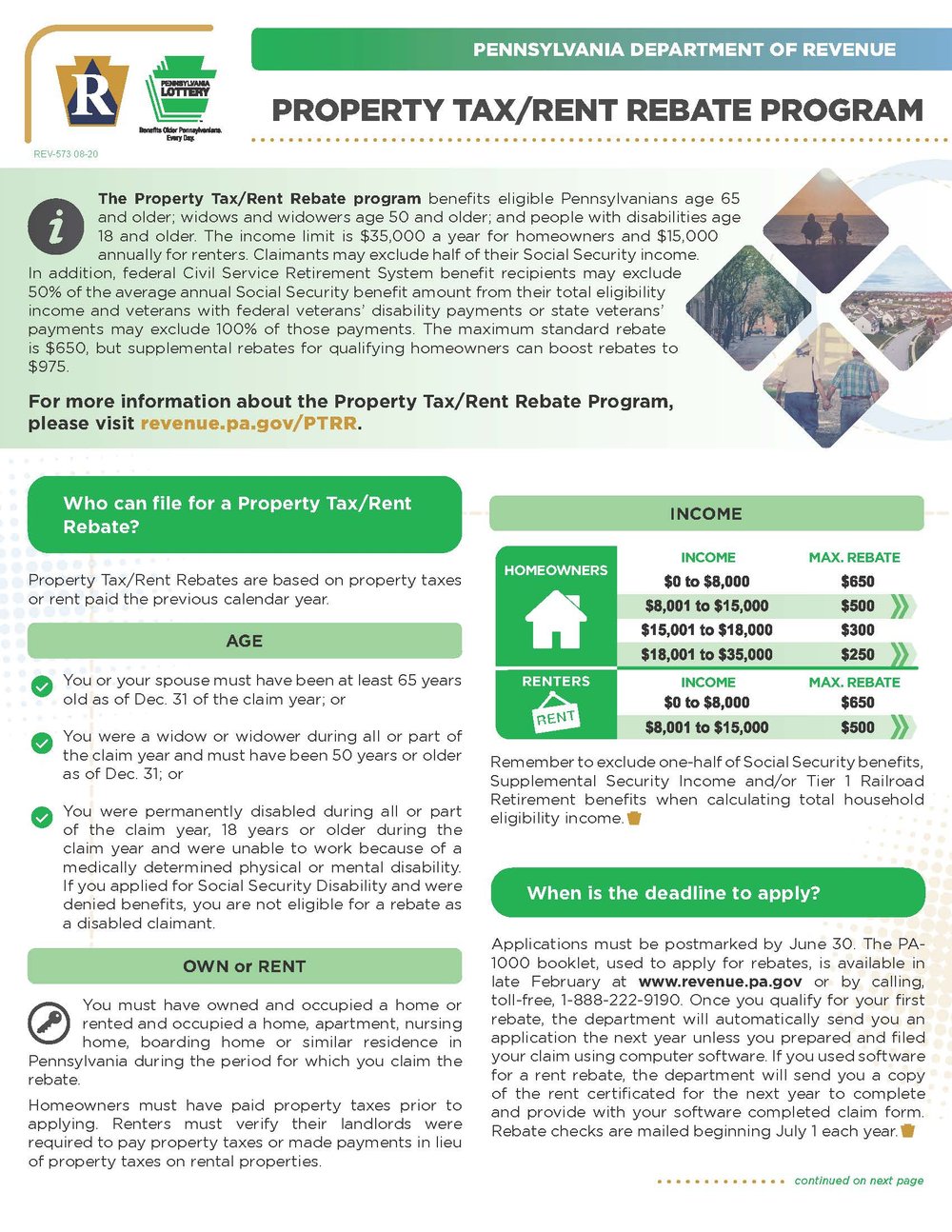

In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value. 135 of home value Tax amount varies by county The median property tax in Pennsylvania is 222300 per year for a. The maximum standard rebate is 650 but supplemental rebates for qualifying homeowners can boost rebates to 975.

Replace property tax revenue with sales and income taxes increase the Personal Income Tax by 185 with those funds staying local to the school district increase the state. This law eases the financial burden of home ownership by providing school districts the means to lower property taxes to homeowners especially senior citizens via the funding provided by. Nonetheless taxpayers most often pay a single.

Property Tax ExemptionsWays To Lower Property Taxes A property tax exemption is one of the best methods of reducing your taxes. Ad PTRC Has Specialized in Reducing Long Island Property Taxes Since 1990. If you want to further reduce your property taxes you can always try these methods.

Ad Based On Circumstances You May Already Qualify For Tax Relief. If you meet the above-listed requirements you will. 65 and older A widow or widower of age 50 and older A person with a disability of age 18 and over The.

Contact Us Today To See How Much Neighbors Have Saved In Your Area. Whether you live in states with low tax rates such as Alabama or Arkansas or get tax bills that exceed 2000every single dollar matters. How Lower Paxton Township Real Estate Tax Works Given power by the state municipal governments conduct property taxation.

Receive a flat 30 property tax. Pennsylvania Property Taxes Go To Different State 222300 Avg. Lowering your property taxes is always welcome.

The Center Square When it comes to property taxes Pennsylvania falls within the top third of states with the highest rates in the country. Skip renovations of your property before the tax assessor makes an evaluation Follow the assessor. The Property TaxRent Rebate Program is one of five programs.

You need to be. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006. PHILADELPHIA CBS-- The advent of casino gambling in Pennsylvania was supposed to help homeowners in the form of lower property tax bills.

Up to 25 cash back Heres an example of how Pennsylvanias assessment and tax system works. The Taxpayer Relief Act provides for property tax reduction allocations to be distributed.

Toll Brothers At Liseter The Merion Collection Pa Luxury Homes Delaware Homes For Sale Home Builders

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Pennsylvania Legal Aid Network

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Pennsylvania Department Of Revenue Parevenue Twitter

Enjoy A Luxury Home At The Charming Hatboro Station Community In Hatboro Pa Luxury Homes Home Builders Home

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Pennsylvania Property Tax H R Block

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

.jpg)

Pa State Rep Property Taxes Time To Eliminate

Sold 340 Debbie Lane In Ground Pool In Ground Pools House Styles Pool

Pennsylvania Department Of Revenue

Texas Map Map Of Texas In Close Up With Blur Aff Map Texas Blur Close Ad Network For Good Texas Map What Inspires You

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Pennsylvania Sales Tax Guide For Businesses

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania