r&d tax credit calculation software

If youre granting the easement to a qualifying charitable organization you can trigger a charitable deduction. Late applications will not be eligible for the credit.

Tips For Software Companies To Claim R D Tax Credits

KBKG is a tax consulting firm that works with large companies and certified public accountants CPAs to deliver specialized tax services.

. And if you are a large company via the Research and Development Expenditure Credit RDEC. Patents and RD tax credit. Basic research is work undertaken for the advancement of scientific knowledge without a specific practical application in view.

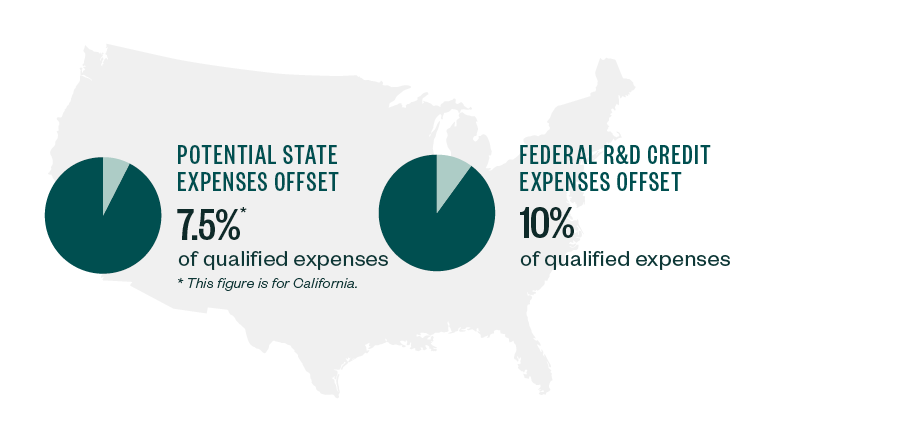

G generally substituting provisions relating to special rule for pass-thru of credit for provisions relating to limitation on amount of credit for research based on amount of tax liability. As an alternative for the above investment deduction for patents and RD a company may opt for a tax credit for which the advantage corresponds to the advantage of the investment deduction ie. RD Tax Credit Calculation.

We provide assistance with RD tax credits cost segregation repair v capitalization review section 45L credits section 179D transfer pricing IC-DISC and California Competes tax creditsWe also offer subscription based. IRC Section 41 explains the RD tax credit in full detail including qualifying criteria credit calculation documentation and certain exclusions. You probably know youre required to report the sale of an easement for income tax purposes.

Basic SRED investment tax credit rate 15. The best step is to incorporate software like Boast Capital to help you organize your RD tax expenses to save your business money. Business owners must demonstrate that their RD activities ie the design development or improvement of products processes techniques formulas software or inventions meet all the.

Companies defined as established firms are firms with gross receipts and QREs in at least three of the tax years from 1984 to 1988. Applications are due September 1 of the year following the year you incurred the expenses. But lets focus on the other option which is selling the easement and go over some tax planning.

A tax credit of 25 applies to the full amount of qualifying RD expenditure incurred by a company on qualifying RD activities. Tax Credits provide an often vital cash injection for businesses and to date Leyton UK has helped thousands of clients successfully claim more than 900m in RD tax relief. An out-of-state company that sells computer software to resellers or end users and provides online computer support services to customers in Washington could be liable for Washingtons wholesaling BO tax retailing BO tax retail sales or use tax and service and other activities BO tax if the company had nexus with Washington pursuant to.

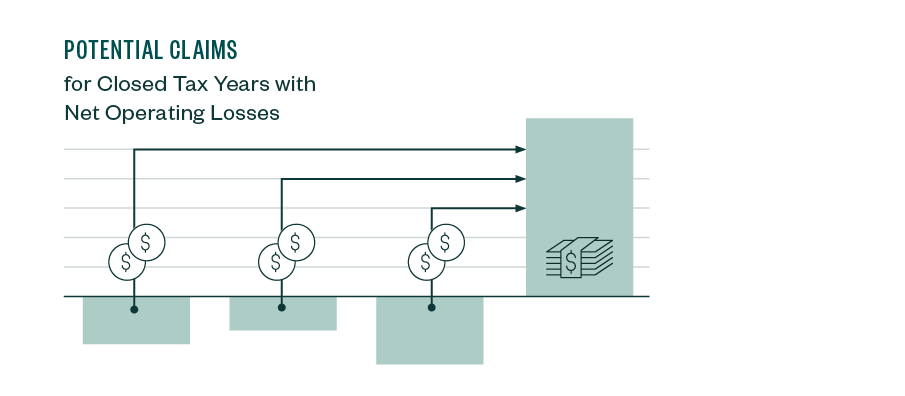

Businesses that carry forward RD tax credits may be able to offset tax liability in future years. Sale of easement tax treatment. A separate RD tax credit is available in respect.

99514 231a1 added subsec. We will send you a letter to certify the credit by November 30. Amortised over 5 years 20k would be charged to the income statement each year.

This credit is in addition to the normal 125 revenue deduction available for the RD expenditure thereby resulting in an effective corporation tax benefit of 375. This is allowable for tax purposes and would generate an RD tax credit up to 33 of each years deductible costs 66k in each year. If you are classed as an SME for RD tax credit purposes your next step will be to make a claim via the SME RD tax incentive.

98369 471c renumbered section 44F of this title as this section. The basic rate of an SRED investment tax credit ITC is 15 for tax years that end after 2013 and 20 for tax years that end before 2014For tax years that include January 1. Our Tax Credit Unit must certify the credit before you can claim it on your tax return.

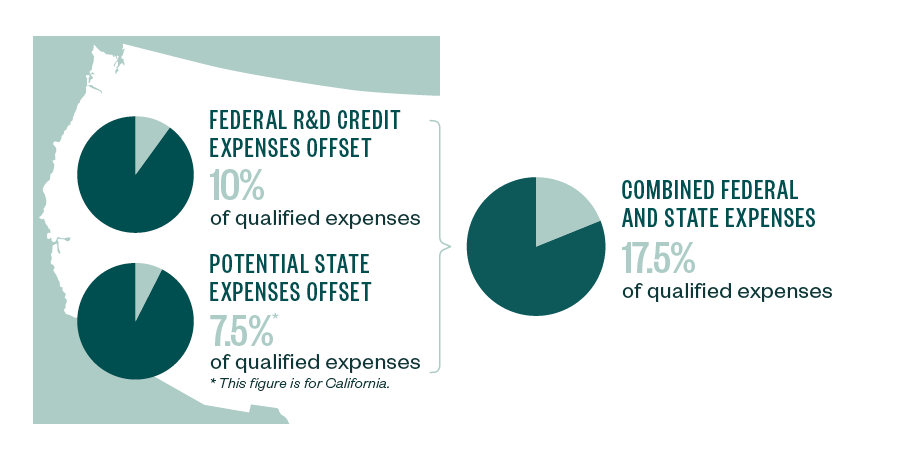

Was the RD tax credit carryforward affected by the Tax Cuts and Jobs Act. The regular RD credit equals 20 percent of a firms QREs above a certain baseline level. 135 one-time and 205 for a spread investment deduction for tax year 2022 multiplied by the normal CIT rate of 25.

The RD Tax Credit scheme is an important government incentive which rewards companies of all sizes that work on innovative projects. To do so they must first perform an RD tax credit study and claim the RD tax credit by filing IRS Form 6765 Credit for Increasing Research Activities. Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax.

100k of qualifying RD expenditure is spent by a business on developing a software platform. However there are a few factors such as grants and subcontracting that can restrict an SME from accessing the SME incentive.

Software Development Industry Tax Credits R D Tax Credit

Tips For Software Companies To Claim R D Tax Credits

Tips For Software Companies To Claim R D Tax Credits

![]()

Timesheet Software For R D Tax Credits Replicon

Tips For Software Companies To Claim R D Tax Credits

Research And Development Tax Credit Tax Insights

Proposal Tracking Spreadsheet Proposal Templates Software Sales Sales Proposal

Tips For Software Companies To Claim R D Tax Credits

The R D Four Part Test Rd Tax Credit Software

Research Insights Business Trends Getapp Resources Small Business Infographic Cloud Computing Clouds

![]()

Timesheet Software For R D Tax Credits Replicon

![]()

Timesheet Software For R D Tax Credits Replicon

What Is R D Tax Credit How To Calculate And Claim It In 2022

Top 10 Free Open Source Payroll Software Edition 2021